Author: Thomas (Tom) Karston Ph.D, Lead Financial Analyst at Vikek

How Should Landfill Tipping Fees for Today’s Customers Help Cover Costs Over Many Decades Into the Future?

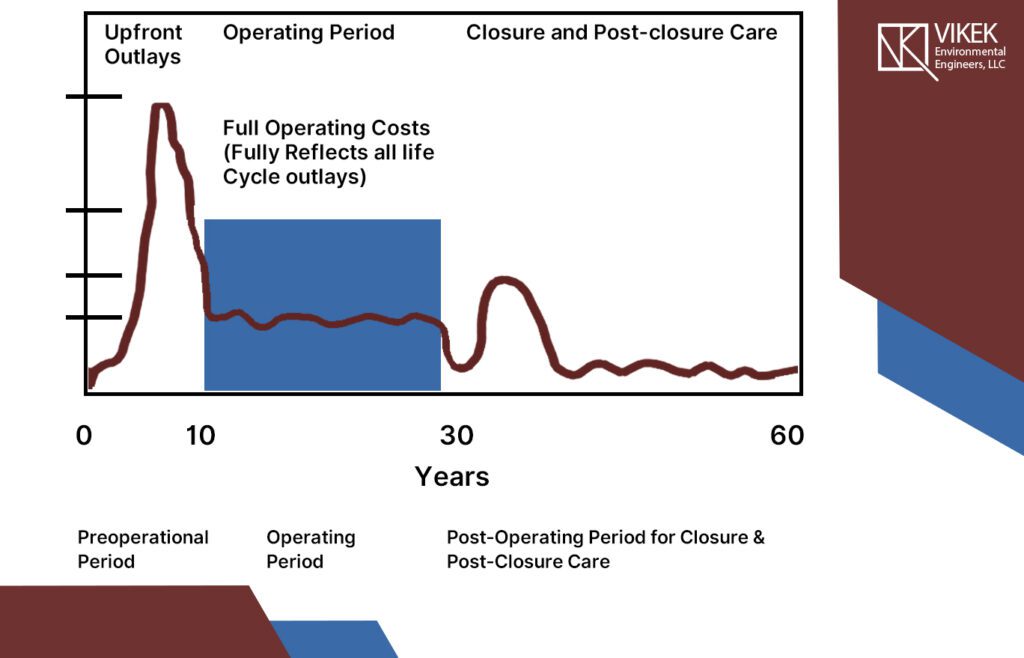

While modern landfill management involves many critical engineering and environmental challenges, the not-so-simple question of how much to charge customers might be even more important. However, while landfill owners have to cover today’s operating costs, their facilities are different from many other capital assets, such as factories, trucks and bridges, because their lives-after-closure can be longer than their years of active service. This is nicely illustrated in the now-classic graph from a 1997 EPA document addressing the lifecycle of landfill outlays:

How should this reality of closure and post-closure costs appropriately be calculated as one of the several components that make up a Tipping Fee paid by customers using a landfill today?

Various federal EPA regulations from the early 1990s require landfills in the USA to “recognize” and begin preparing for closure and post-closure costs, starting from when they first begin receiving waste. These regulations can be satisfied by setting up trust funds, letters of credit, surety bonds, corporate guarantees, state and local grants, or other such mechanisms that can cover the many costs incurred after a landfill stops receiving waste. However, some states are more specific, and require that cash-based reserve accounts be set up, as restricted funds, meaning that they can only be used for the costs of future closure and post-closure maintenance. But these regulatory obligations to recognize costs in annual accounting statements do not directly require that these future expenses are somehow appropriately reflected in prices paid by customers in the early years. Indeed, in many jurisdictions landfill costs are partly covered by a diversity of sources, including city and/or state general funds, various types of grants, specific MSW taxes on private businesses, and from fees paid by households or companies using the landfill directly or indirectly.

With this considerable mix of approaches to paying for landfill services, it is possible that many of today’s customers might not pay an amount that has been specifically calculated to include a component ensuring that waste dumped today takes into account its share of costs that will be faced by the landfill perhaps only starting some 30 or 40 years into the future, and then continuing for decades.

One approach to developing this component of a Tipping Fee is to ignore these far-off costs and set today’s pricing to reflect today’s political, budgetary and commercial pressures. Another approach is to recognize a landfill’s future closure and post-closure costs in today’s accounting statements as a liability and address the need for future cash disbursements at closing using one of the mechanisms mentioned above.

This analytical approach has considerable appeal to management boards, regulatory agencies, end-users, and the general public, as it helps increase acceptance of an organization’s policies, pricing, and overall legitimacy.

To help achieve this result we work with management to carefully refine estimates of several key variables:

- How long is the landfill currently expected to operate?

- How many tons of refuse will it be receiving during each of the remaining years of service?

- What are the possible future capital costs of expanding the current landfill before it closes?

- What are the expected costs of final closure?

- For how many years will post-closure maintenance be required?

- At what interest rate can a landfill reserve fund balance be invested – during active operations and throughout the entire post-closure period?

A major advantage of our approach is that it requires management to be transparent about these key variables. It also allows management to analytically explore how different assumptions about these parameters can affect this important component of an overall Tipping Fee proposal.

While this blog post focuses on the benefits of determining how to appropriately charge current customers for their impact on a landfill’s full lifecycle costs, a forthcoming post will take up the broader question of how to determine the numerous other components that should be included when setting an optimal Tipping Fee.

Vikek Environmental Engineers has the personnel with many years of experience in addressing all these issues and producing results that have been smoothly approved by elected political leaders and outside advisory groups, and also certified by a variety of external financial and public health auditors.

If you would like to discuss these intriguing pricing issues further, in a detailed but complimentary consultation, please contact the firm at this link.